- Business Transformation

- Sales & Revenue Optimization

- Finance & Operations

- Information Technology

- Private Equity

- Healthcare & Life Sciences

- High Tech

- Manufacturing

- Explore All Industries →

- Advisory + Diagnostics

- Change Management

- Implementation Services

- Cloud Application Managed Services

- Integrations

- Data Analytics

- Accelerators

- Cloud Applications

- Success Stories

- Insights + Events

- About Us

Effects of the Inflation Reduction Act of 2022 (IRA) on the energy and utility industry may be as surprising as the Act is divisive. Impacts range from a renewed focus on capital planning to an unexpected sell-off of unregulated renewables. Is the energy and utility industry ready to take on the changes, expected and unexpected, associated with the IRA?

The various tax incentives offered to organizations that invest in clean energy projects force energy and utility executives to reconsider their capital planning. To stay competitive, energy companies need to consider the tax implications of their clean energy projects and initiatives – or their lack thereof.

Making these tax incentives work for your energy or utility organization means taking control of your capital and supply chain planning. Legacy systems or siloed data won’t bring your company the deep insights and agile decision-making it needs to keep competitive.

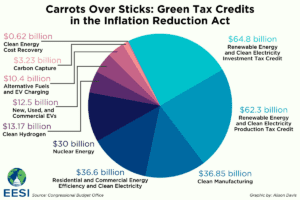

Available Energy IRA Tax Credits

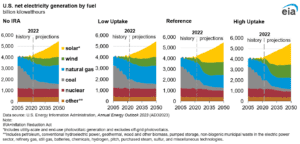

The US Energy Information Administration’s (EIA) annual energy outlook for 2023 notes that “the IRA’s tax credits provide an incentive to add solar and wind over natural gas-fired generation, which makes them more attractive for replacing retiring coal assets and meeting incremental demand.” The 2023 outlook projects that the IRA provisions push wind and solar to 56% of electricity generation by 2050.

According to the EPA, the Inflation Reduction Act “allows taxpayers to deduct a percentage of the cost of renewable energy systems from their federal taxes. These credits are available to taxable businesses entities. The Inflation Reduction Act extends the Investment Tax Credit (ITC) of 30% and Production Tax Credit (PTC) of $0.0275/kWh (2023 value) through at least 2025, as long as projects meet prevailing wage & apprenticeship requirements for projects over 1 MWe.” Building renewable energy infrastructure in this timeframe requires agile coordination of assets to optimize delivery of construction and other related projects.

The Challenges

With the increasing demand for such renewable energy sources, it makes strategic sense to invest in renewable energy infrastructure in the near future, and the truly nimble will be able to take most advantage of the opportunities provided by the IRA’s available tax credits before they expire. This presents a significant opportunity, but it also requires companies to make rapid decisions about how to optimize their capital planning and supply chain management.

Regulated vs. unregulated renewables

In an unexpected consequence of the IRA, a series of Fortune 500 utility companies dumped older renewables. It is proposed that these companies are selling off their current unregulated renewable portfolios to utilize the benefits of the Act on new renewable projects.

This highlights the market changes that energy and utility companies face in responding to changing regulations and economic conditions. Companies that are unable to adapt quickly risk falling behind their competitors and losing market share. Making such decisions requires agile planning capabilities and scenario planning to forecast the impact of such selloffs. Companies with forecasting and budgeting plans that depend on siloed, inconsistent data may be unable to make accurate, data-supported decisions as quickly as they need to. Those who take advantage of real-time data in a connected planning system will be better equipped to meet this opportunity.

Renewable component shortage

An additional, but not impossible, challenge to realizing IRA renewable energy benefits is, unsurprisingly, supply chain management. Components of renewable energy projects, such as solar panels, are in incredibly high demand and low supply in the US. This is partly because there are few domestic manufacturers of such materials (a gap which IRA incentives also look to remedy), and partly due to the holdup of solar panels and other components in US ports. The import of Chinese materials manufactured wholly or partly in China is currently blocked by Uyghur Forced Labor Prevention Act, targeting human rights violations in the area.

Such supply chain issues have become common in recent years and addressing them requires deep visibility into a company’s supply chain at a granular level many organizations do not fully achieve. Companies with access to connected, real-time data will be able to make agile, data-driven decisions to keep supply moving. Those who fail this will struggle to remain competitive.

Realize IRA tax opportunities with a better planning partner

Are you able to evaluate your capital plans deep into the future and evaluate scenarios among your management team? The clock is ticking. Companies that connect, automate, and streamline their capital and supply chain planning processes now can benefit from the IRA tax credits. With proven expertise in implementation, adoption, and managed services for connected planning programs, Spaulding Ridge can help you get there. And get you there fast!

To see what connected planning may look like for your organization, contact Eric Maloni or Nick Verzino. Together with Spaulding Ridge, you will see further into your company’s future.