- Business Transformation

- Sales & Revenue Optimization

- Finance & Operations

- Information Technology

- Private Equity

- Healthcare & Life Sciences

- High Tech

- Manufacturing

- Explore All Industries →

- Advisory + Diagnostics

- Change Management

- Implementation Services

- Cloud Application Managed Services

- Integrations

- Data Analytics

- Accelerators

- Cloud Applications

- Success Stories

- Insights + Events

- About Us

We are experiencing an historically significant supply and demand imbalance within the maritime shipping industry as it relates to ocean container rates. This is due to a confluence of factors, including carrier induced reasons (slow steaming vessels, blank sailings etc.), COVID-related reasons, port congestion, and an influx of post-pandemic demand.

Today, we’re seeing the convergence of all supply chain issues simultaneously in the form of longer lines, high rates (the Consumer Price Index has risen nearly 5 percent, double from before the pandemic), and scarcity, while anyone prompted to provide a reason gives a disgruntled response about mysterious “supply chain issues.”

While truly solving and mitigating supply chain disruptions in this day and time would require a mighty combined effort of multiple countries, organizations, and otherwise, individual companies can make different choices. If we look towards the origins of the disruptions, we can find ways to ease the pains of an overloaded and under-fueled supply chain.

Made in China

That little gold “Made in China” sticker is a prevalent part of the disruption going on right now. Even when products aren’t completely made in China, many countries, including Japan, South Korean, Taiwan, and the US, use China as a final assembly place – which is where many of our problems begin.

For the duration of COVID, production capabilities were, and continue to be, significantly depressed in China and other parts of Asia, with factories closed across the region and fewer transpacific cargo moves.

Additionally, several Asian ports experienced shutdowns during 2020 and continue to experience the same COVID-related closures this year. In the last month alone 3 of the top 20 global ports experienced COVID-related closures – Shanghai (#1,) Ningbo (#3) and Ho Chi Minh Port (#14). These closures caused an uptick in blank sailings (regularly scheduled port calls that are skipped), increased anchorage time, and delayed sailings worldwide.

Due to the slowing of economies across the world, demand for certain product groups diminished for a time, but as the world’s economies have begun to open back up, naturally there’s been an infusion of desire for goods and ability to buy. This, in turn, has led to increased production throughout Asia.

Increased Demand, But No Increased Solutions

Demand is back up. That sentence on its own seems to be a good thing, but there aren’t solutions to handle that demand with ports and factories throughout China still closed. There’s a severe mismatch between demand and supply, one that will likely take months to rectify.

The United States’ buying habits play a significant role in how strained the supply chain is, but the problems with the supply chain far predate today, predating the pandemic as well. The pandemic, and subsequent increase in demand, aggravated a nearly broken system to fracture.

There are specific things we can point to putting excess strain on this system, including:

- Labor shortages

- Shuttered terminals

- Limited space at shipping yards and warehouses (stemming from the labor shortage)

- Breakout consumer demand in North America

Ocean carriers have begun increasing their transpacific cargo capacity to meet this influx of demand, at a rate near 22% (Mongelluzzo, 2021), however, port congestion in Asia and the US is inhibiting shippers from capitalizing on this increased capacity and is actually putting further upwards pressure on freight rates.

At first glance, the increased supply of shipping capacity should be enough to handle the increased demand, however the situation is made worse by delayed sailings due to closures, the aforementioned blank sailings (regularly scheduled port calls that are skipped), congestion at terminals, and downstream domestic transportation infrastructure issues (chassis shortage, intermodal inefficiencies, etc.).

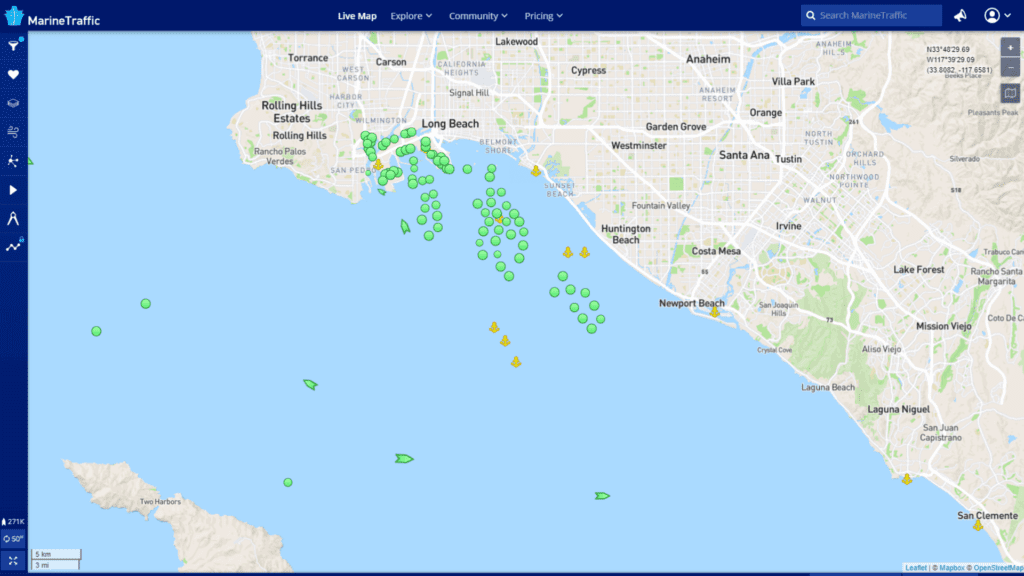

The port congestion on US West Coast ports is at an all-time high. In August, the Ports of Los Angeles and Long Beach, the 2 largest US ports, hit a record, having over 40 ships at anchor.

IMAGE COURTESY OF MARINE TRAFFIC BLOG.

All these issues combined are causing a never-before-seen increase in transpacific ocean rates, with increases of 1000% or more – and ocean carriers aren’t helping the situation by deliberately keeping capacity well below the demand to move freight through their business practices.

Take, for instance, the 71 agricultural and food industry trade groups who wrote a letter to President Biden accusing ocean container carriers (none of which are headquartered in the US) of “declining to carry our export cargo… [and] preventing us from delivering affordably and dependably to international markets.”

Why? Because these ocean carriers, at their highest, can command upwards of $20,000 dollars per trip from Asia to the US. A trip in the opposite direction (US to Asia) commands only $400 to $1,800 due to the Right to Fair Pricing laid out last year by the FMC (Federal Maritime Commission) after prices skyrocketed to exorbitant levels.

These record low inventory levels due to limited space or denied shipment on vessels are leaving shelves empty across the country, and consumers will inevitably feel the strain of increased pricing and low availability of desired goods. Economists are predicting this shortage will continue at least through Chinese New Year, with some saying it will persist into 2023.

Ocean carriers and freight forwarders are making more money than ever before, and there is little motivation for them to change this. The fact of the matter is that economic chaos is lucrative for transportation companies.

Difficult Situations Require Creative, Data-Driven Solutioning

Is there anything a company can do to mitigate some of this hardship? The answer is – yes, at least to some degree. However, everyone is paying the higher rates – there’s no avoiding this for the time being – so the question really is: how do you secure and guarantee space for your cargo? What are the best robust strategies for mitigating supply chain disruptions?

There are different solutions to this problem for different sized companies. Larger companies like Walmart, Nike, etc., are chartering vessels or sharing charters of vessels to ensure that their goods get on the boat. However, even these vessels are subject to delays caused by port congestion, but at least the space is guaranteed.

So, with everyone paying higher prices, how do you as a medium-to-small sized shipper ensure that the slots on the vessels you book do not get bumped? By finding creative, data-driven solutions.

Here are a few strategies.

Ensure you are working with the right partner (freight forwarder).

The right partner will be large enough to have influence with the ocean carriers by having slots allocated on vessels that align with your trade lanes so that your bookings do not get bumped. In addition, they will have actual field offices (not agency offices) at your specific ports of origin since many decisions on whose cargo gets onboard a vessel can come down to relationships. These two things will help secure space for your cargo.

Also, make sure that your cargo is immediately offloaded from the vessel and onto its onward mode of transportation. You do not want your container getting stacked, and likely stuck, at the destination port. This may cost a little extra but could significantly reduce delivery delays. This, admittedly, is more difficult since it requires your containers to be loaded last at the origin port, and many origin ports do not have that capability.

You can also offer to pay all freight costs upfront. While this is a bit unorthodox, many carriers are offering guaranteed space for pre-payment. Find out which carriers provide this service and have your forwarder work with them.

Consider alternative transport options.

Be willing to change your ports of origin and destination. If you have a forwarder that actively watches spot rates and space availability on a day-to-day basis, they may find alternate ports of origin and destination. For example, if you normally ship cargo to west coast ports and there is no space, consider shipping to gulf ports or the East Coast instead – where there is more capacity available and lower congestion.

These are unprecedented times, and all options are on the table. More costs and coordination, but inventory to sell. There are companies that are now focusing on moving cargo across the country to service these types of shipments.

Use A Supply Chain Optimizer.

As stated above, there are continuing high risks associated with the factors impacting availability of in-region stock to fulfill demand. Most sourcing strategy processes look at a number of variables to determine where a company should be making their products, such as production costs, quality, order minimums and maximums, production completion timelines, ability to obtain raw materials, and ability to adjust machinery (tooling, fabrication machines, etc.) to meet changes in product design and transportation/logistics costs.

Optimizing tools have the ability to layer a risk evaluation on each of these variables, helping companies identify where risk mitigation strategies are needed. For example, the analysis from the optimizer could lead to critically important decisions such as moving toward dual sourcing, regional sourcing, or the changing of supplier purchase terms.

Use Scenario Planning in Inventory Management.

Identify your fast and consistently moving SKU’s and decide if your business can afford to cover increased inventory carrying costs. If so, scenario planning can help you figure out which of the following strategies, or combination of strategies, could help the most:

- Consider what the impact this situation has had on your lead time and increase your safety stocks levels to cover your inventory needs. Just-in-time strategies are no longer effective in today’s economic environment, as the risks are so high with the lack of available space and the threat of production facilities and ports shutting down again due to COVID variants.

- Pull forward PO’s and/or produce more goods earlier and move them to the US warehouses. Even if early production does not align directly with current demand, make and ship those products ahead of time and move them to distribution centers in the US now so that products are available to sell later.

- Decide which alternative ports of origin and destination are most cost effective for you and work with your forward to implement Plan B, C, etc.

Similarly, if a company can get the proper inputs from transportation service providers, then the inventory management model could also be used for dynamic landed cost calculations and mode selection. For example, if a shipment is moving from South China to the US west coast with an inland move to Iowa, the scenario planner could be configured to account for the current contract ocean freight rates, the current ocean spot rates, and the cost of moving the shipment by air freight. While this requires continual inputs, analysis can help inform tactical decision-making related to both fulfillment timelines, sourcing locations for a PO (assuming there is dual sourcing in place for key products) and costs.

Robust Strategies for Mitigating Supply Chain Disruptions at Spaulding Ridge

In addition to the above-mentioned use of Integrated Supply Chain Planning applications, like Anaplan and Coupa, there are other areas where we can provide direct assistance to our clients. Many do not understand the dynamics involved in international shipping and leave critical decisions to their freight forwarders. This can be costly and ineffective in terms of securing space or mitigating cost increases.

Here at Spaulding Ridge, we can provide the robust strategies for mitigating supply chain disruptions that you need. Our professional services come in the form of strategic and tactical planning in international transportation and Logistics, as well as alignment of production, transportation, and distribution silos within the companies to make Integrated Supply Chain Planning a valuable tool to address the current and future chaos. The disruptions are far from being over – we know this. Let’s adapt and overcome the best way we know how – utilizing best-in-cloud technology and some creative solutioning.

Reach out to Kristin Zemenak at [email protected] to talk about a customized plan for your business.

Sources:

- Crane Worldwide Logistics (2021, August). Ocean Market Update

- Mongelluzzo, B. (2021, August 30). Port congestion sapping major Asia-US ship capacity injection Journal of Commerce

- Chambers, S. (2021, August 26) More than 40 ships waiting outside LA and Long Beach setting new record