- Business Transformation

- Sales & Revenue Optimization

- Finance & Operations

- Information Technology

- Private Equity

- Healthcare & Life Sciences

- High Tech

- Manufacturing

- Explore All Industries →

- Advisory + Diagnostics

- Change Management

- Implementation Services

- Cloud Application Managed Services

- Integrations

- Data Analytics

- Accelerators

- Cloud Applications

- Success Stories

- Insights + Events

- About Us

What is xP&A?

The Financial Planning and Analysis (FP&A) process is universally accepted as a fundamental part of supporting an organization’s financial health. Continuously budgeting, forecasting, and analyzing reports to monitor performance can identify potential returns and has the ability to assess further potential.

What if that planning and forecasting extended past the financial department? The “x” in xP&A is indicative of just that – extending the FP&A principles into other areas of the business. Planning happens every day across companies, siloed, as sales makes targets, marketing runs campaigns, HR determines talent acquisition, and production provides resources and capacity. All departments contribute to a company’s bottom line, so getting them on a single planning platform is integral to creating a successful, agile business.

It is an unsurprising development and has been well in the works with cloud planning platform, Anaplan, for years.

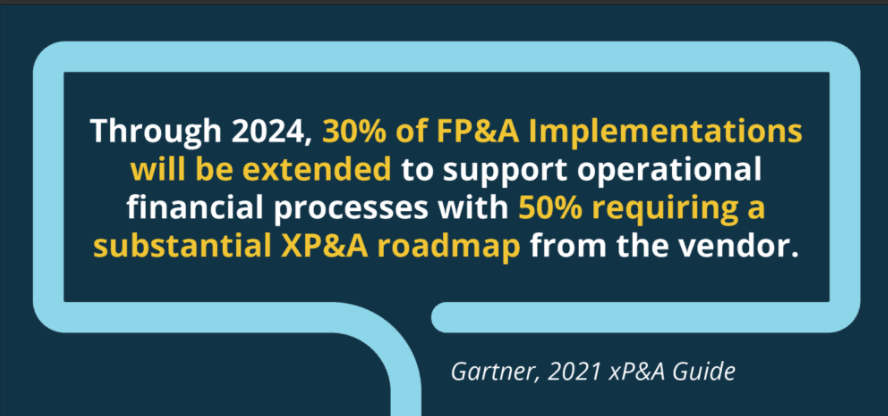

As of 2021, Gartner has addressed this expanding version of FP&A, not only referencing Anaplan as a pioneer vendor solution, but also saying that Extended Planning and Forecasting is the “next generation extension of financial planning and analysis solutions.”

So, it’s not about choosing between FP&A and xP&A – it’s about extending FP&A capabilities, leveraging finance’s connection to all other sectors of your business and driving higher-quality decisions and outcomes.

Anaplan, Connected Planning, and xP&A

In 2017, Anaplan debuted a new category of cross-functional continuous planning called “Connected Planning,” which, today, is a 1-to-1 match of what Gartner is calling xP&A. It’s also the only vendor that provides “a fully packaged and marketed xP&A [application], sharing the same platform and common data model enabling both the consolidation and integration of the solutions” across multiple business functions, according to Gartner.

That’s a mouthful, but it boils down to this: Anaplan extends the planning capabilities of a standard FP&A tool to the operations of an organization. Empowering operations to plan outside the Chart of Accounts, connecting financial outputs to operational data across:

- Supply Chain

- Marketing

- Sales

- HR

- IT

Connected Planning (xP&A) Business Benefits

FP&A implementations have become a standard practice, alongside practices such as workforce and sales and operations planning (S&OP), but why are these two systems separate when they depend so heavily on each other?

xP&A includes numerous add-ons to FP&A, including:

The capability to handle larger data volumes and granularity for both financial and operational planning applications.

Artificial Intelligent/Machine Learning (AI/ML) to identify and automate patterns and anomalies.

Enhanced, integrated financial planning (IFP) for connectivity and integration of third-party data.

“xP&A is a vendor response to these evolving enterprise planning needs. They help organizations exploit the challenges faced when introducing new digital business models and navigating economic uncertainties.” – Gartner xP&A Marketing Guide.

“xP&A is a vendor response to these evolving enterprise planning needs. They help organizations exploit the challenges faced when introducing new digital business models and navigating economic uncertainties.” – Gartner xP&A Marketing Guide.

Single source of truth. For as strategic as having a sole source of truth is, it can be difficult to enforce. With each department having their own systems and separate “sources of truth,” it can take some legwork to get the actual full picture of your business. With everything housed in one platform with an xP&A strategy, all decision makers and planners are looking at the same information in one location, resulting in better overarching company decisions.

Real-time, holistic visibility. Since there’s a true single source of truth for your company, your xP&A application functions as a living, breathing mechanism within your company. Decisions can be viewed through the impact they have on the business as well as the impact they have on individual departments.

Agilely pivoting with business demands. The pandemic forced businesses to reassess priorities on a scale that was unseen prior. Adjusting individual departments or sectors is one thing, but when, basically overnight, there are full-scale changes that need to be made immediately to even keep the lights on – that’s an entirely different beast. While this is a dramatic (albeit very real) example of the need to agilely pivot with business demands, the future is still in the throes of uncertainty. Being prepared for any possible circumstance has never been so necessary.

Automated continuous planning. At the core of xP&A is the action-reaction cycle. Changes in one plan are accounted for in other plans using Machine Learning (ML) and Artificial Intelligence (AI), such as Anaplan’s PlanIQ offering. It’s your business, in sync, automatically.

Full business alignment. Aggregation of forecasting and planning with company-wide data makes it easier to identify cost-saving and growth opportunities, as well as ensure that all departments are unified in their goals.

Planning outside the chart of accounts. Financial results of the planning process don’t start their life in the chart of accounts — they end there. Production plans, operations schedules, product volumes, customer mix, etc., separate out to provide better insight into the effectiveness of different areas of your business.

These individual areas of your business are often not thinking first and foremost about the general ledger (GL) account where their outputs land.

Anaplan allows users outside of the finance department to focus on operational process modeling (such as Demand Planning, Sales Forecasting, Workforce Planning) , then associating the end result to the final resting place, the GL Account.

For organization’s that have an existing enterprise FP&A solution in place, ask yourself how much of the model’s output would remain if the COA were removed? For many Anaplan users, detailed operational planning models still reside and can be analyzed, scrutinized, and reported on, in addition to the standard ledger hierarchy-based reporting and analysis.

Anaplan Connected Planning (xP&A) & Your Business

If you’ve been advocating for an FP&A solution for your finance department, start there. Understand the capabilities and the value of analyzing and modeling scenarios – knowing that scaling (especially with an application like Anaplan) isn’t only possible, it’s a core functionality.

If you’re on track with FP&A, xP&A is the next logical step – via Anaplan.

Anaplan & Legacy Financial Planning Systems

“When I founded Spaulding Ridge in 2018, I selected Anaplan as our best-in-cloud solution for enterprise planning because of its industry leading ability to connect financial and operational planning for our clients. After years of implementing enterprise planning tools, I knew that an effective planning solution needed to be more than an aggregated set of largely static budgets.” — Spaulding Ridge CEO, Jay Laabs.

Unlike legacy financial planning systems, Anaplan has the ability to complement existing technology and can help users extract incremental value out of their legacy software investments.

- Using historical data on existing legacy plans as a source, Anaplan is able to quickly stand up a planning model to get forward-looking answers.

- Since Anaplan can use historical data, businesses who implement Anaplan on top of legacy, on-premises software can realize the same ROI, if not more, as businesses who upgrade their Enterprise Performance Management (EPM) system.

When it comes to reading data, inconsistencies between systems are typical, but that doesn’t mean they have to slow down or derail the process. Many companies won’t have (and don’t need) a data warehouse but do have a solution already in place to handle data. Typically, these allow for exports or queries and can use tools to extract the data, which can then be fed into Anaplan. Anaplan does an excellent job shining light on any inconsistencies that need to be accounted for so the fix can easily be handled upstream.

Take Your FP&A to the Next Level with xP&A Today

Extended Planning and Analysis has the ability to integrate planning processes and data business-wide, which, while valuable in stable times, is even more integral during unstable times.

Don’t just react to what’s happening in the marketplace – be ahead of it with Anaplan’s xP&A offering, Connected Planning.

Contact Matt Cain at [email protected].

About Spaulding Ridge

Spaulding Ridge is a global cloud advisory and implementation firm that helps leading companies deploy Best-in-Cloud solutions. Spaulding Ridge enables organizations to accelerate operational efficiency, drive digital transformation, and increase competitive advantage.

Spaulding Ridge partners with digitally savvy companies to help:

- Finance gain control: Increase top-line revenue, gross margins, and profits through better insight. Connect financial planning to strategy and automate financial close processes.

- Sales increase productivity: Manage quota and territories more consistently and effectively, automate customer contracts and onboarding.

- Operations drive efficiency: Improve supply chain agility, automate strategic sourcing and purchasing, deliver superior customer service experiences.

To learn more, visit spauldingridge.com.