- Business Transformation

- Sales & Revenue Optimization

- Finance & Operations

- Information Technology

- Private Equity

- Healthcare & Life Sciences

- High Tech

- Manufacturing

- Explore All Industries →

- Advisory + Diagnostics

- Change Management

- Implementation Services

- Cloud Application Managed Services

- Integrations

- Data Analytics

- Accelerators

- Cloud Applications

- Success Stories

- Insights + Events

- About Us

Due to the size and breadth of utilities companies, there is a large reliance on capital, making it critical to plan for capital expenditures and the related initiatives accurately and precisely. Capital planning for utilities can make up billions of dollars’ worth of investments, impacting the broad financials and operations of these companies across the board.

When you have a capital-intensive business, it’s crucial to strategically plan for the future.

Capital Planning Models & Trends

In the last decade, capital investments for utilities companies have continued to rise. Higher capital expenditure is required in a competitive landscape where earnings growth is closely tied to effective capital spend.

The utilities industry is seeing a shift in focus and prioritization, though, as new policies from consumers and stakeholders alike push the industry to be more environmentally conscious. The 5-year capital spending model now often needs to include these new initiatives, switching to solar, wind, and other clean energies, which could lead to large-scale gains.

Do you have the appropriate technology to handle large-scale gains? Is it adaptable and scalable?

Legacy Systems in the Capital Planning Process

The capital planning process is difficult as-is, but many companies use archaic on-premises tools or spreadsheets, which can often make the process even more arduous.

These legacy systems tend to be slower and inefficient when compared to cloud-based planning tools – they’re less agile and are harder to make quick changes or projections due to a lack of things like real-time information.

A cloud-based system, like Anaplan, is made to be customizable towards your specific capital planning needs. Plus, it allows for real-time changes and faster consolidation so you can pivot based on changes and create models on the spot to accommodate new needs.

Why the Big Migration to the Cloud?

As more and more companies make the switch to cloud-based planning tools, historical problems around capital planning no longer plague the process. When making the switch to a cloud-based platform such as Anaplan, companies can expect to no longer be dealing with:

- Lack of visibility on cash flow leading to increased bad debt

- Finding the right plan detail level that allows for operational considerations

- Issues related to planning speed, making changes and projections, and communicating capital planning for different purposes such as regulation considerations and restrictions

Anaplan: Capital Expenditure Management Software

Choosing the right capital expenditure management software allows utilities to plan for capital investments and initiatives in real time, with the ability to see how the addition of potential capital projects will affect their financials over time.

By using a nimble and fast tool, utilities have the flexibility to decide how precise they want to be when it comes to planning. Most utilities look to plan at the program or project level and there are key benefits and drawbacks to consider with each approach:

- Program Level: A program is a strategic initiative, oftentimes comprised of a group of projects. By planning at this level, companies can plan at an executive, high level, providing for a broad business view of the initiative or capital program. It’s easier to maintain this level of planning, however, this may not always provide the granularity needed for necessary analysis

- Project Level: Planning at this level provides utilities with deep detail and thorough information on their capital spending. Project level detail can get more specific and provide additional insights, however it is more challenging to maintain

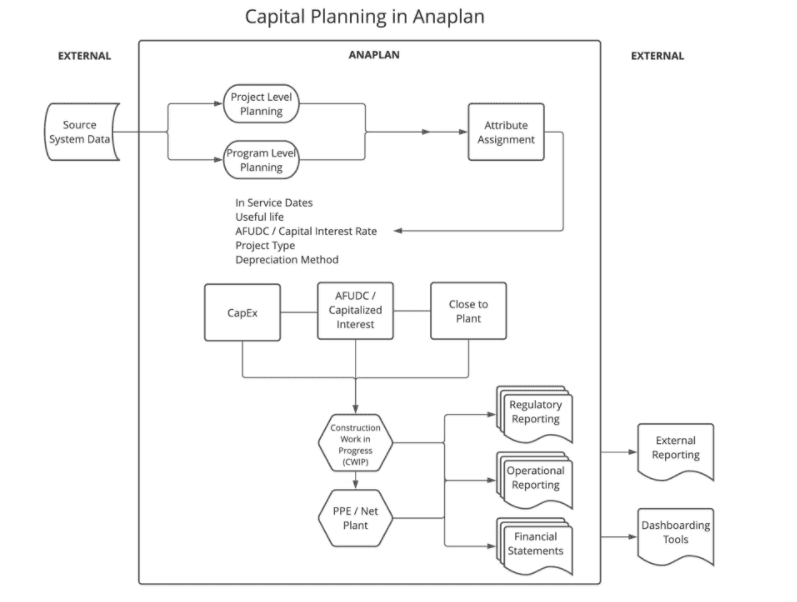

Once the level of detail necessary for planning is established, Anaplan allows for the ability to load and integrate historical capital data all the way down to the project level from existing source systems, as well as the addition of new projects and investments within the Anaplan platform itself.

With the high level of regulation in the industry, there are often requirements and standards around capital reporting for regulatory purposes. To be able to do said reporting easily and accurately, utilities can leverage the platform to tag specific attributes to each capital investment.

Once the investments live in Anaplan, these attributes can be assigned upfront and maintained as needed moving forward, ideally at the lowest level of detail deemed necessary. Project or program level attributes may include:

- Regulated versus non-regulated

- Project type

- Asset type

- Funding type

- Date of capital spend

- Date of service / date of close

- Associated plant or station

- Interest rate

- Depreciation methodology

- Rank / prioritization

Above is an example of Capital Planning for a Utility company, where attributes are being assigned to projects and investments. Attributes can be customized for relevancy to the business; they can be manually entered or populated via logic. Once entered, attributes can drive necessary calculations and reporting.

All of these attributes live in Anaplan and directly drive the reporting for accurate planning and budgeting of existing and new investments. Once the programs or projects are created, the corresponded attributes can then be loaded in or populated directly.

Moving forward, attributes only need to be maintained should they change. You no longer need to worry about re-populating and updating project or program details for each monthly report.

Attributes have wide benefits, not only qualitative, but they can also be quantitative too, driving necessary capital calculations that provide accurate financial statement impacts in real-time as planning is being iterated. After planning your initial capital expenditure investment, the attributes can automatically drive the rest of the components, including Construction Work in Progress (CWIP) amounts for reporting.

Other financial considerations are also driven by these capital attributes, such as:

- Capital Expenditure amount

- Useful lives

- Closed amounts

- AFUDC or capitalized interest

- Depreciation

- Residual value

- Taxes

These capital specific financial impacts need to be accounted for on the company’s income statement, balance sheet, and cash flow statement. Once the attributes are entered, as well as the initial base investment amount, Anaplan will update the calculations live, so you are provided with accurate and timely financial impacts, allowing for companies to plan reliably and quickly.

Reports can also be automatically updated and generated as these values are entered. Should something change, the cloud-based platform will have that accounted for immediately, as to not interrupt planning efforts.

With all of these components coming together, utilities companies no longer have to worry about sending around spreadsheets or running lengthy processes in outdated systems.

Everyone from the operational controllers at the stations or plants, up to the finance directors and corporate team will be able to see where the company stands with their capital investments across a planning horizon using one centralized, live source.

[1] Data brought in from source system to Anaplan [2]Decision made at what level to plan at (program versus project) [3] Attributes entered for at necessary level of detail determined for planning for historical and planned capital expenditures [4] Capital expenditure values calculated [5] Associated capital costs calculated [6] Reports refresh with associated calculations and attributes in necessary structure [7] Capital data integrated into financial statements

Spaulding Ridge & Capital Planning Management

Our Spaulding Ridge team has extensive experience assisting large enterprises in the utilities industry with capital planning, greatly reducing turnaround times and increasing precision and accuracy.

To talk about capital planning, reach out to Jenn Ruder.