- Business Transformation

- Sales & Revenue Optimization

- Finance & Operations

- Information Technology

- Private Equity

- Healthcare & Life Sciences

- High Tech

- Manufacturing

- Explore All Industries →

- Advisory + Diagnostics

- Change Management

- Implementation Services

- Cloud Application Managed Services

- Integrations

- Data Analytics

- Accelerators

- Cloud Applications

- Success Stories

- Insights + Events

- About Us

Large-Enterprise Revenue Leaders Face a Sales Crediting Dilemma

Between improving economic conditions and the ever-present shortage of sales talent, sales leaders are relying on more complex sales incentives structures. Incentives are helpful for both motivating sellers to close deals and retaining top talent (talent retention being a top priority according to our recent CFO Survey), but giving credit where credit is due is a challenge.

Fundamentally, there seem to be two simple questions to answer for sales crediting: who gets credit, and how much credit should they get? But there’s more to it than that. How are new hires credited? How do territory rules affect compensation? Which of your products are eligible? How can two reps share credit for a deal? And how much is a new account worth compared to a renewal? Unsurprisingly, there’s often a lot of work needed to arrive at the final sales credit.

Many enterprise businesses already utilize ICM tools, but those tools are only one part of a fully functional crediting system. Sales leaders can try to calculate transactional data in workflow applications such as their customer relationship management platform (CRM) or sales planning tool, but those often lead to increases in cost—not to mention performance issues, since those systems aren’t designed to be your entire crediting system. Others will do these calculations manually, but that also poses challenges. More complex crediting rules are harder to check and harder to understand intuitively, making them more likely to not be followed.

A true solution to sales crediting is possible. Companies that can deliver a comprehensive, effective solution will benefit from happier, more engaged reps, less work for sales operations, and a stronger pipeline.

Sales Crediting Relies on Four Data Sources

Companies aiming to perfect their sales crediting will need several systems playing specific roles. Before beginning to build the multi-system solution, make sure the following are prepared:

- Incentive Compensation Management (ICM) Tool: This is the tool that most companies will already be using for their entire sales crediting process. Likely, you’re using a connected planning tool, which is the right approach—for making the plan and for giving reps a front-end interface to use, at any rate. On the other hand, it’s expensive and cumbersome to do your calculations here, and you’ll likely need other sources of data to get the full picture.

- Data Warehouse: Your data warehouse is where the sales crediting calculations should take place. Not only is it more economical to handle these calculations in a tool built for heavy-duty data work, it also makes sure that the data you need from other sources is already there.

- Customer Relationship Management (CRM) Platform: To state the obvious, it helps if your sales crediting process has up-to-date sales data. Pulling that data from your CRM will be critical to coming up with accurate and fair sales figures—for instance, reflecting whether a specific deal is for a new project or a renewal.

- Enterprise Resource Planning (ERP) Platform: Finally, the transaction data from your ERP also needs to be part of the picture. Simply put, your sales crediting should reflect what your company actually earned from each deal, taking into account the amount, profitability, and more.

Each of these components have certain pieces of the incentive compensation management puzzle. To get the full ecosystem right, however, means thinking about how data flows through them as well.

Nailing Your ICM Process

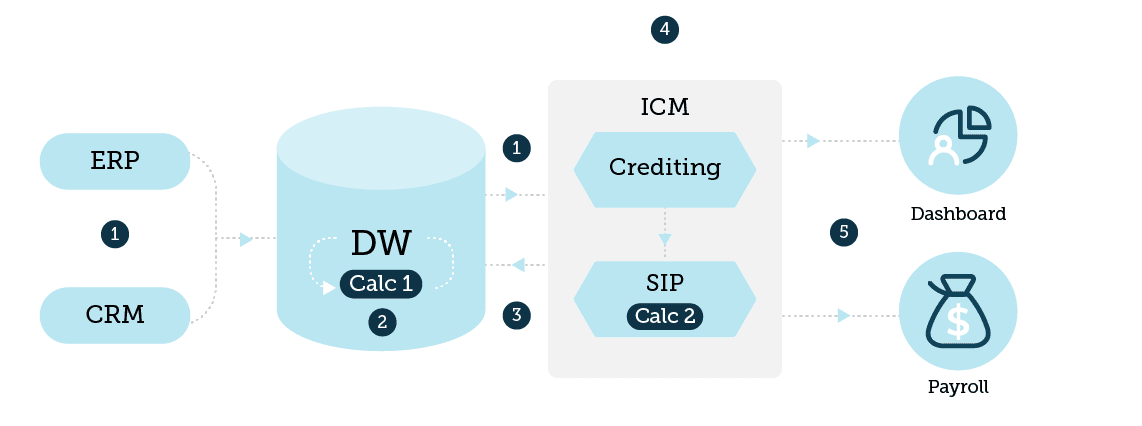

The key to ICM isn’t just the right systems: It’s also about the right processes. Getting the flow of data through multiple technologies means knowing how they all fit together, when one piece of data gets passed from one system to another, and how. It can be helpful to think about this as a step-by-step process aligned to this flowchart:

Let’s review this process step by step:

1. Data from your ERP, your CRM, and your ICM system flows into the data warehouse.

Because, as we’ve discussed, you’re doing your first round of calculations in your data warehouse, the first step is to make sure all your data is there from the beginning. The data warehouse should pull instructions for how to calculate sales credits from the ICM system, the actual transaction data from the ERP, and customer data from the CRM.

2. The first calculation occurs in the data warehouse.

The first calculation is the most data-intensive step—in usage-based crediting models, this can be tens of millions of sales transactions per month or more—so handling it in your data warehouse will be the most economical option. If all the information we discussed above was fed into the data warehouse effectively, you should be able to get a fairly accurate calculation on your first pass, providing transaction-level credit assignment to sales reps. At this stage, you should have a fairly accurate calculation already.

3. Your initial crediting calculations are passed back into your ICM system.

But fairly accurate isn’t good enough where your reps’ bonuses are concerned. To make sure you’re providing totally fair crediting, your data warehouse should pass the credited transactions back into the crediting model, where you can adjust numbers to account for any adjustments that always seem to arise with sales crediting. If staff turnover, changing rules, or an ambiguous sales situation require you to adjust how a specific deal is credited, this is where it happens.

4. Your ICM passes the data into your sales incentives planning system for the second calculation.

For the second and final calculation, the crediting module passes data to the sales incentives plan model. Actual compensation is calculated by running sales crediting data through sales incentive plan business rules. At this stage, you have sales crediting and payout data, finalized and ready to go.

5. The final calculations are sent to payroll and viewable in an executive dashboard.

The final data goes to two different places. First is payroll—because your reps will want the bonuses they earned. The second is reporting. Sales leaders will want a view into how their incentives are working, and whether they’re motivating sellers to close the right deals in the right way. Ideally, you’ll already have a suite of sales reports ready to go, and your reporting solution will be able to provide this data to your executives within that same reporting structure to make their lives easier. Sales leaders should quickly be able to see what deals have been made, what the crediting rules are, what incentive compensation has been disbursed, and what progress they’ve made towards their goals.

However, reporting can be a useful tool for frontline reps too. In one recent implementation for a software-as-a-service company, we gave reps the option to do their own “what if?” calculations, letting them see the impact of a closed deal on their compensation. This kind of reporting capability can provide a strong incentive for sellers to get back out into the field.

Getting Sales Crediting Right Has Clear Benefits

Beyond happier sales reps, an upgraded crediting process provides quick benefits to revenue and profitability too, increasing deal velocity and giving your leadership better strategic insights into what’s moving the needle. It’s a process that’s worth making the effort to get right. If you’re curious about how a system like this could benefit your team, we’re happy to talk!