- Business Transformation

- Sales & Revenue Optimization

- Finance & Operations

- Information Technology

- Private Equity

- Healthcare & Life Sciences

- High Tech

- Manufacturing

- Explore All Industries →

- Advisory + Diagnostics

- Change Management

- Implementation Services

- Cloud Application Managed Services

- Integrations

- Data Analytics

- Accelerators

- Cloud Applications

- Success Stories

- Insights + Events

- About Us

Introduction: IBP Has a Place in Finance

Integrated business planning (IBP) has received extra attention in manufacturing over the last five years, driven by the global supply chain and economic turmoil that started with COVID-19. A strategic process to navigate business uncertainty, IBP aligns operational planning with business financials to drive decision-making at the Executive level. Although commonly led by supply chain teams, IBP in the hands of a CFO sponsor is particularly effective for aligning the organization around strategies and tactics that mitigate risk and deliver results.

Integrated business planning is a well-documented process, and the strategic and financial benefits it can provide are compelling. A recent McKinsey study found that compared with companies that lack a well-functioning IBP process, the average mature IBP practitioner realizes up to two additional percentage points in EBIT, among other benefits. CFOs are ideally suited to sponsor the effort.

A Best-Practice IBP Framework

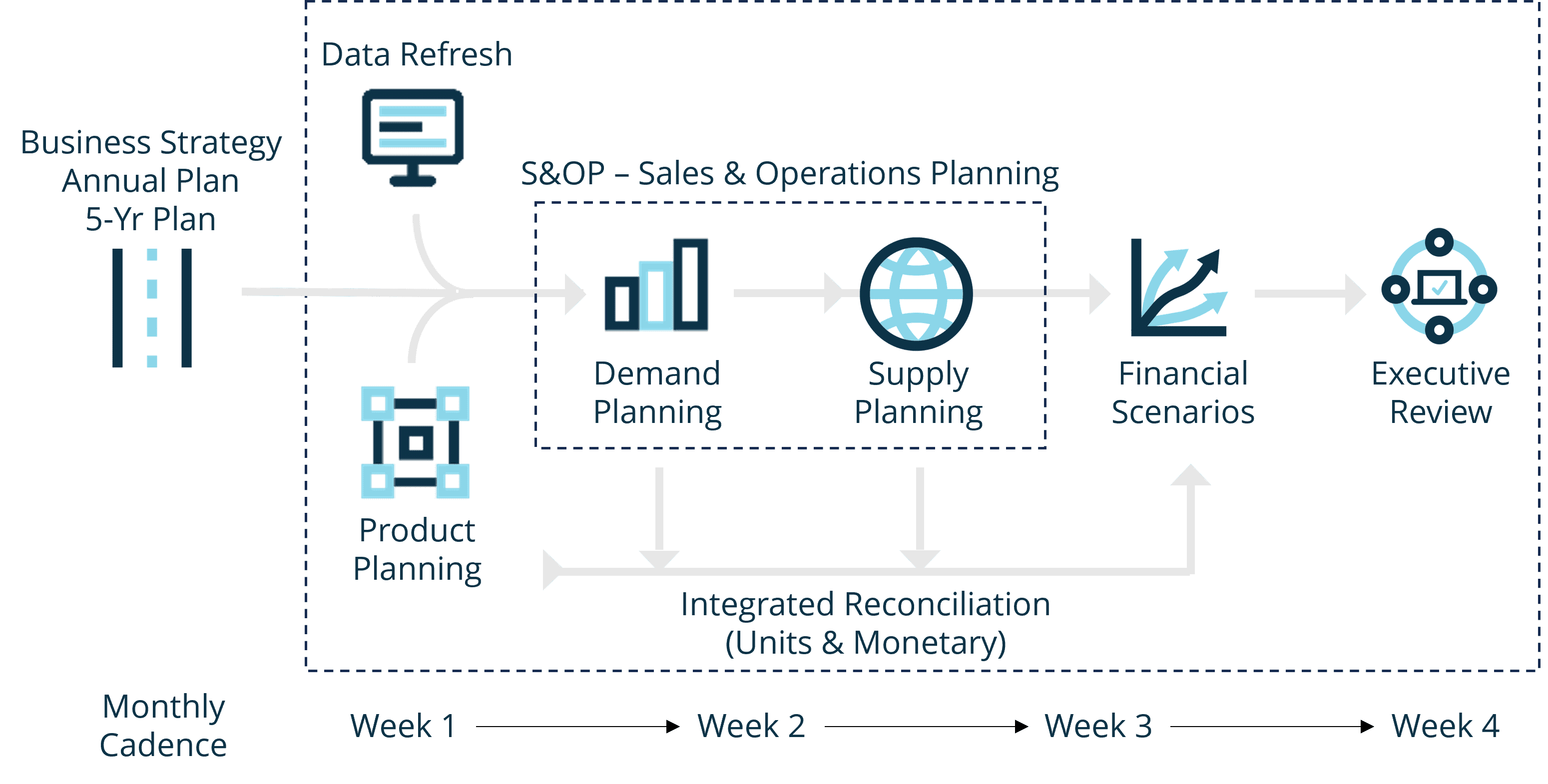

In the simplest terms, IBP aligns executives to make decisions. A company compares bottom-up actuals and business intelligence against top-down strategy and objectives. How is the business really performing against its stated goals? Where are the gaps that require action? Scenarios are used extensively to quantify business risk and opportunities into a solution space of directional outcomes that leaders should consider. This diagram provides an overview of the process.

IBP is built around a repeating monthly cadence of analysis and conversations between leaders, culminating in an executive review of findings and decisions. Companies assess their product portfolio to determine if future development efforts will deliver planned revenue on schedule, and they balance salable demand against available supply capacity in a process known as Sales & Operations Planning (S&OP). They reconcile data and assumptions against each other and tie each to financial plans, with an ultimate objective of identifying decisions that need to be made.

IBP implementation involves multiple stakeholders, large amounts of data, and discipline. It’s best to start simple, aligning around key business performance challenges that require cross-organization alignment. IBP will naturally adapt and mature over time as the business learns. If you’re just starting, there are three key qualities to remember that will set your IBP up for success:

- Strategic. Businesses should start with an 18- to 24-month forecast that grows into longer planning horizons as the IBP process matures. Products and services should be considered at some level of aggregation, allowing you to see the demand and operational themes without getting bogged down in SKU-level transactions. Integration of IBP to long-range planning, including product portfolio offerings and CapEx, will confirm that robust strategies and countermeasures are in place to drive long-term growth.

- Reconciled. IBP creates a framework to reconcile data, assumptions, and forecast drivers across the organization. Actual performance is summarized and compared to forecasts, while near term and longer-term assumptions are compared against each other to ensure continuity over time. The purpose is to identify and resolve planning inconsistencies, with an objective of improved forecast quality and alignment.

- Financial. Most importantly, forecast data and driving assumptions should connect directly to the company’s financial statements for a financial line-of-sight on decisions and impacts. The key is to create a continuous view of how and why your financials are changing.

As you consider your own IBP roadmap, use the following equation as an easy way to remember the key guiding principles:

IBP = (S&OP + Strategy + Reconciliation) x Finance

The Strategic Value of Finance-Led IBP

IBP led through the office of the CFO has a powerful impact on strategic decision-making, financial planning, and resource allocation. The CFO—a leader accountable for company capital and advising the CEO on strategy—benefits from unifying operational decisions and financials while aligning the executive team around risk scenarios. IBP enhances finance’s strategic impact within the organization.

Beyond the core impacts, however, there are other ways IBP helps a CFO. By embedding financials into IBP, a CFO helps the organization understand the broader implications of operational decisions from multiple financial dimensions. And from an organizational perspective, IBP makes it easier for the CFO to provide insight into competing versus compatible objectives while aligning competing versus collaborative teams.

Spaulding Ridge’s recently published CFO Survey Report uncovers several urgent financial challenges faced by CFOs which are directly addressed through integrated business planning:

- Retention of talent/managing headcount. Labor is a significant cost for businesses, and companies should use IBP to connect capacity requirements to workforce planning that optimizes labor cost.

- Cash flow planning/forecasting. Volume projections, inventory countermeasures for risk, extended supply chains, and CapEx investment to fund growth are critical elements for cash flow forecasting—and core parts of IBP.

- Supply chain. IBP helps leaders better understand supply chain capacity, inflation, and lead time factors, providing integrated financial reconciliation and scenarios while creating a financial risk profile for the business.

- Forecast accuracy. Continuously refreshed demand and operational forecasts, along with underlying organizational assumptions, can be measured against actuals to identify levers for accuracy improvements.

Finance has a valuable perspective here. By seeing the impact of operational decisions from a financial point of view, the CFO increases their effectiveness as a strategic leader while ensuring operational decisions are financially sound.

IBP Requires Specific Capabilities

The repeating nature of Integrated Business Planning requires organizational discipline and business standardization. As your monthly process matures, it becomes critical to have the right capabilities to manage the massive amount of data, assumptions, and scenarios involved. The right tools will keep conversations focused on business insights rather than gathering and verifying data.

- Data consolidation and visibility. IBP requires a common platform for consolidating data from different systems and different parts of the organization. Having the ability to quickly validate your data and facilitate management by exception will be critical to bringing the right information into the process. Informational dashboards will be especially useful: You can provide leaders with data directly related to the decisions and insights that are required.

- Workflow management. In larger organizations, especially those spanning multiple locations and time zones, the coordination of a bottom-up performance assessment and forecast is a complex undertaking. Organizations will need to be able to define the sequence and timing of activities to execute their monthly IBP process, send participant notifications, and track workflow execution performance to facilitate continuous improvement.

- Specialized capability. IBP requires more intelligent analytics that extend insights. Useful functionality includes the ability to automatically identify and set alerts for data and analysis conditions, statistical or machine learning for demand forecasting, and optimization for product mix and resource allocation.

- Scenario modeling. IBP cycles are typically run monthly or quarterly, depending on the type of business and rate of change in data and assumptions. Each cycle will have multiple scenarios built around risks, opportunities, and uncertainty. These scenarios and assumptions should be captured and used to bridge changes over time and against the annual budget.

- Automation and efficiency. IBP requires repetitive planning tasks around data aggregations, analytics, and report creation. To save time and reduce errors, organizations should have the ability to automate what they don’t need to do manually. This will allow the IBP team to focus on value-add discussions about the business.

IBP is an Opportunity to Transform

By integrating financials deeply into product, service, and operational decisions, a CFO-led IBP process drives dramatic improvements in forecasting of revenue, expenses, and cash flow. The result is greater organizational alignment and enhanced strategic decision making that’s grounded in operational knowledge. Through IBP, CFOs bring financial expertise, strategic decision-making, risk management, performance measurement, and cross-functional collaboration to the planning process, leading to more effective and financially sound business planning. Let’s get started.