- Business Transformation

- Sales & Revenue Optimization

- Finance & Operations

- Information Technology

- Private Equity

- Healthcare & Life Sciences

- High Tech

- Manufacturing

- Explore All Industries →

- Advisory + Diagnostics

- Change Management

- Implementation Services

- Cloud Application Managed Services

- Integrations

- Data Analytics

- Accelerators

- Cloud Applications

- Success Stories

- Insights + Events

- About Us

Things may get worse before they get better.

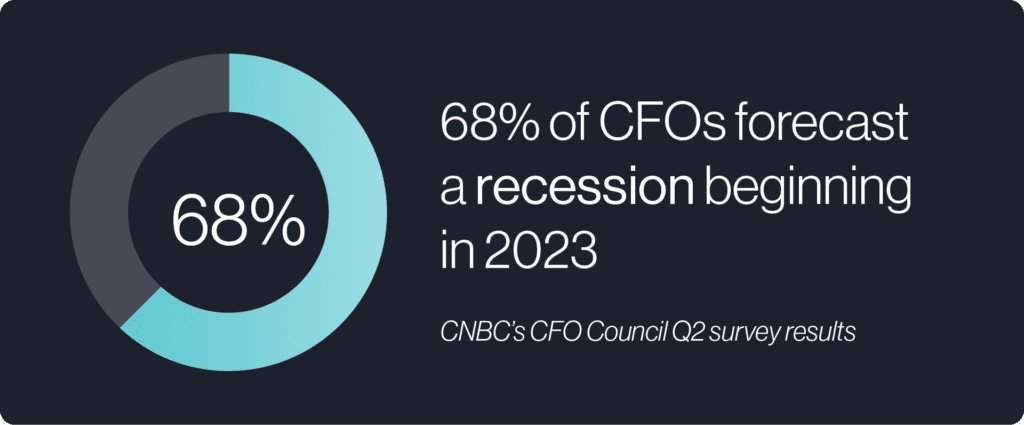

No matter who is conducting the survey, CFOs predict a difficult economic outlook. Even when they’re confident that the Federal Reserve will keep inflation under control, they believe a recession is inevitable. CNBC’s CFO Council Q2 survey results show that 68% of CFOs forecast a recession beginning in 2023, and none predict it later than the second half of 2023.

Economists are similarly pessimistic, speculating that if the recession does not happen in 2023, it will be significantly more severe if pushed to 2024 or 2025. To blunt inflation, the Federal Reserve has hiked interest rates to the highest they’ve been in 28 years, while the World Bank just slashed its global growth outlook, and the European Central Bank raised its interest rates for the first time in 11 years. The US is facing its largest year-over-year inflation rates since 1981 at 9.1% and the European rate is close behind, at 9%.

And yet there are reasons for optimism as well. Fuel prices have fallen, inflation has shown signs of abating its growth, and many economies have taken steps to untangle supply chains. Unemployment remains low and consumer spending remains high.

The world has been a mix of the foreseen and unforeseen and very little of it has been beneficial to running a business profitably because, at the end of the business day, speculation is easy; certainty is hard. Leaders can make their predictions based on sound data and financial know-how, but even the best predictions can fail in the face of unexpected circumstances.

CFOs are in the unenviable position of planning for slowed macro-economic growth, potential stagflation, and interest rates not seen in over a decade, while continuing to manage core business needs.

With so many fluctuating variables at play, CFOs need hard data wherever they can get it. Continuous outlook forecasting, elevated spend management, and strong data governance—in short, digital finance transformation—will benefit finance leaders no matter where the market goes.

‘Digital finance transformation’ is a weighty coupling of words that, when put in action, does require dedication and investment. Despite being a long journey, the return on that investment, the value, can be derived immediately when executed properly, making it ideal to start at any time – even, and perhaps especially, when facing economic uncertainty.

Combined with transparent collaboration, digital finance transformation can result in the most coveted of business states: resiliency.

1. CFOs need to embrace integrated technology platforms that scrupulously monitor business spending.

Based on a study of more than 500 chief financial officers (CFOs) and senior financial executives conducted by The Economist Intelligence Unit, more than 60% of CFOs lack complete visibility into transactions within their own organizations.

On the other side of the coin, a majority of that same group of CFOs think leveraging new technologies or improving processes (like managing business spend) would enable organizations to work better with other functions while executing the core financial strategy and simultaneously helping to mitigate risk.

The need for transparent financials from top to bottom is crucial to support resilience through a potential recession.

Reaching operational efficiency and curbing unnecessary spending helps companies’ bolster their bottom line and maximize contributions to cash reserves for support during a tough period, as well as cycling that cash into new divisions or areas which are showing strength during the updated economic conditions. When it comes to understanding what can (and should) be cut, what can’t, and how to divide pressure equally across the company rather than applying it all to one area, CFOs will need to turn to cross-departmental collaboration to manage spend while resourcing departments effectively.

Quality data that’s accessible across the company is key to understanding spend and aligning your teams. When everyone is on the same page and working towards the same goals, your long-term financial strategy will run more smoothly, even in difficult times.

2. CFOs need trusted data to overcome the budgetary challenges associated with supply chain disruptions.

CFOs are continuing to have difficulty projecting revenue for 2023 for many of the reasons outlined above. As prices rise and supply chains struggle to meet demand, CFOs need data to know where to cut costs, pass through cost increases, and to invest.

Enter scenario planning. Instead of planning for unprecedented situations every 3-5 years, businesses need reliable data sources to perform continuous scenario modeling, because trusting the numbers leads to readiness and resiliency.

How would your business fare if COVID lasts 10 more years with intermittent shutdowns? What if gas prices double again? What if you can’t hire people fast enough? If China continues to shut down all factories under their Zero Covid policy, is your business going to stay, re-shore, or completely offshore?

This is less about having a single financial projection with all impacted variables proving to be what actually transpired – this is focused on executing as many permutations of economic/operating variables as possible to uncover which conditions present the risks and opportunities to the organization. Further, and most importantly, this is about trusting the results of those scenarios to further enhance business readiness and resiliency.

Many companies have explored using a data warehouse and a suite of connected software to get to a single source of truth (SSOT). When you have one place to go for reliable, trusted information at any given time, you have the key to financial planning.

Scenario management is one tool in the toolbox, and it works well alongside traditional business intuition. Performing continuous scenario management and adding levels of accountability for financial results will allow your business to react quickly during even unprecedented scenarios.

3. CFOs need to implement tailored, connected software platforms and leverage cost-effective managed IT services to compensate for talent scarcity.

Technological advances make life easier—or at least they should. But of the 100,000 software companies, millions of apps, and thousands of new devices every year, how many of them are truly improving your day-to-day life?

Digital finance transformation can be one of the useful advances, but it’s crucial that you know ahead of time what you want to achieve and how you want to achieve it. If your goal is attracting and retaining talent, great. If it’s leveraging automation to eliminate human error, also great. If it’s creating a trusted repository of enterprise-wide data that can be leveraged to make better business decisions, perfect.

Whatever your reasons, there needs to be an adequate roadmap to follow from the start of the journey to the very end.

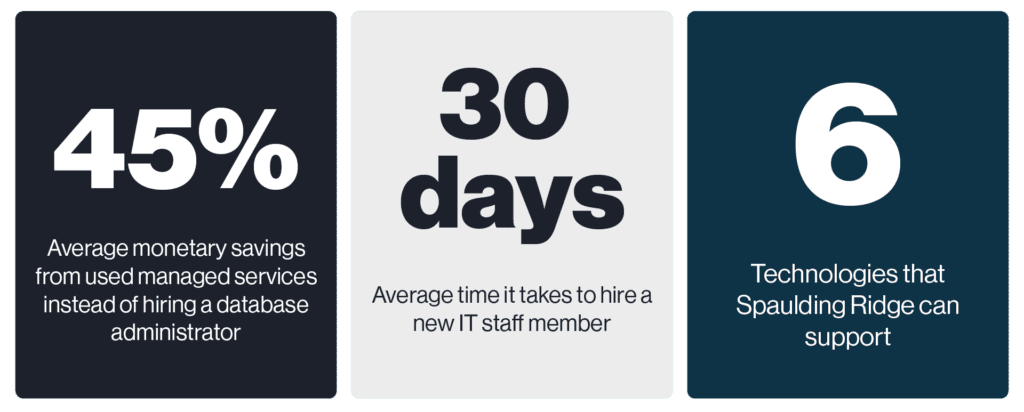

Technology and software need to be implemented, maintained, and upgraded to continue to provide the promised advantages. That in turn takes solid talent – that’s where things can become difficult. Currently in the United States, there are 11 million job openings but only about 6.7 million people looking for jobs. This has caused a huge talent scarcity, and it’s hit the world of technology especially hard.

Despite inflation and the uncertain economy, computer and IT spending as a category is expected to grow 3% worldwide, which says something about the value of technology in today’s world. There are a lot of reasons more companies are turning to technology or upping their budgets for Gartner-quadrant software. Machine Learning and automation are massive advantages—on top of the sheer joy of eliminating tedious tasks, it allows employees to do things that matter for the business, innovating and feeling fulfilled in their career.

Managed services are another great option for retention. Outsourcing software platform administration and enhancements lets your team focus on what your business does and increase efficiency.

The fact of the matter is: new hires want to be able to make a difference. Businesses need to come to the table with the resources talent needs and understand the value of data, allowing new and current employees to have pride in not only their impact but in the company as well.

Begin Your Digital Finance Transformation Today with Spaulding Ridge

CFOs will carry the results, successful or not, through challenging economic periods. At Spaulding Ridge, we help CFOs reach operational efficiency using technology, develop trust in data, and foster a transparent environment for making better business decisions that all lead to business resiliency.

Speak with Sam Kubek or Matt Cain today about how technology can help your business be resilient.

ABOUT THE CO-AUTHOR, MATT CAIN

ABOUT THE CO-AUTHOR, MATT CAIN

Matt Cain is an Associate Partner at Spaulding Ridge. Matt leads the Western Canadian Market and specializes in supporting clients in all facets of their enterprise technology transformation initiatives.